39+ Calculate Bonus After Tax

Web The Percentage Method or flat-rate method. The monthly distribution would be 875.

Autel Maxiim Km100 Schlusselprogrammierwerkzeug 2023 Neueste Autoschlussel Wegfahrsperre Lese Schreib Klon Chip Transpondersimulation Frequenzerkennung Ikey Fur Universelle Schlusselgenerierung Amazon De Auto Motorrad

Web Finally calculate the state bonus tax withholding using Colorados 463 state bonus tax rate.

. After taxes that 1000 drops to 780. The withholding rate is based on your tax bracket. Web 12 on the next 31500 480750.

Supplemental wages like bonuses are subject to tax withholding by your employer. Estimate the actual total after taxes. Under this approach your employer withholds 22 of your bonus for federal income tax purposes.

The total amount of federal income tax due on the 85000 would be. Web There are two methods for calculating the taxes on your bonus. The Aggregate method and the Percentage method.

5000 5 250. Ad Get Deals and Low Prices On turbo tax online At Amazon. Web With the aggregate method the tax withholding on your bonus is calculated at your regular income tax rate.

Web With this method a flat rate of 22 as of 2021 is applied to your bonus amount regardless of your income tax bracket. For example lets say you received. If you make 70000 a year living in Arizona you will be taxed 9877.

Your average tax rate is. Are bonuses taxed higher than your regular. Web since it is based on both your.

Amount of bonus Gross earnings per pay period Number of allowances claimed. Employer does use this method your bonus will be. And 22 on the next 43225 950950.

Bonus and most recent. So whats the deal. Most employers use the.

1000 x 00463 4630 in Colorado state bonus taxes. Web My Bonus After Taxes Do I Have Enough Retirement Money. My Bonus After Taxes Did you receive a big bonus check from your employer.

Welcome to the Bonus Tax Calculator our. Web How Are Bonuses Taxed. Web If youve ever gotten a bonus youve been there right.

Web Arizona Income Tax Calculator 2022-2023. Web Use this calculator to help determine your net take-home pay from a company bonus. Note that bonuses that exceed 1 million are.

5000 22 1100 2. Web The bonus tax calculator calculates the take-home bonus pay after-tax deduction using flat percentage and aggregate method. Web Most employers tax bonuses via the flat tax method where an automatic 25 tax is applied to your payment.

We Offer a Variety Of Software Related To Various Fields At Great Prices. For instance if you receive a 5000 bonus. If the total bonus or bonuses amounts to less than 1 million in a.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Jane accepted a job with a 3500 sign-on bonus paid over her first four months. Web Estimate how much youll owe in federal income taxes for tax year 2023 using your income deductions and credits all in just a few steps with our tax calculator.

How Bonuses Are Taxed Calculator The Turbotax Blog

Trade Fair Pharmacy Market Become An Exhibitor Expopharm

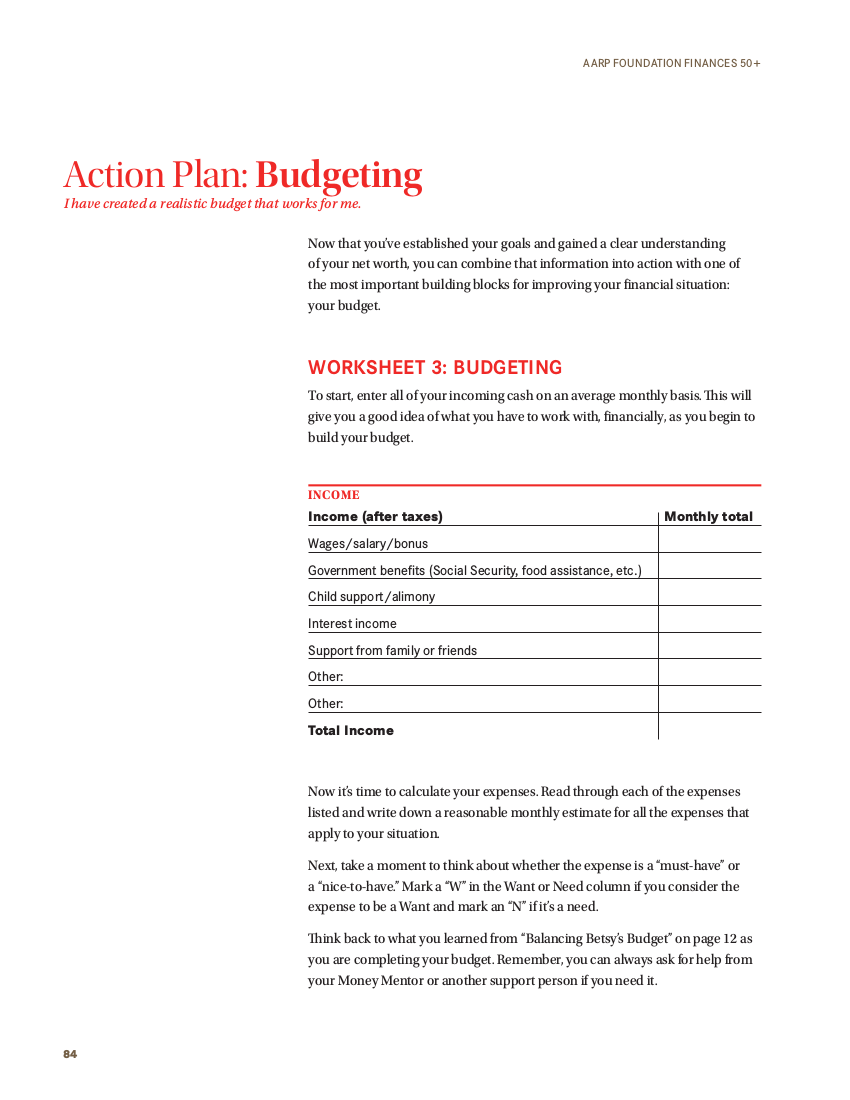

Budget Action Plan 9 Examples Format Pdf Examples

How Much Tax Will I Pay On My Bonus And How Much Will I Take Home Article Surrey Taxaccolega

39 Samples Of Stub Templates

Bonus Tax Calculator Percentage Method Business Org

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

New Tax Law Take Home Pay Calculator For 75 000 Salary

39 Ways To Experiment And Profit With Affiliate Links What Is Affiliate Marketing Brilliant Affiliate

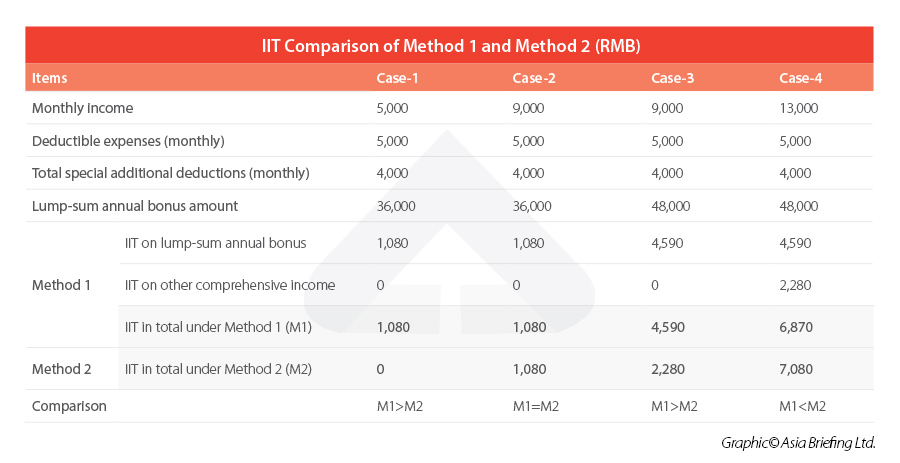

China Annual One Off Bonus What Is The Income Tax Policy Change

Is It Just Greedy And Selfish To Want To Tax People Based On Wealth And Not Income Quora

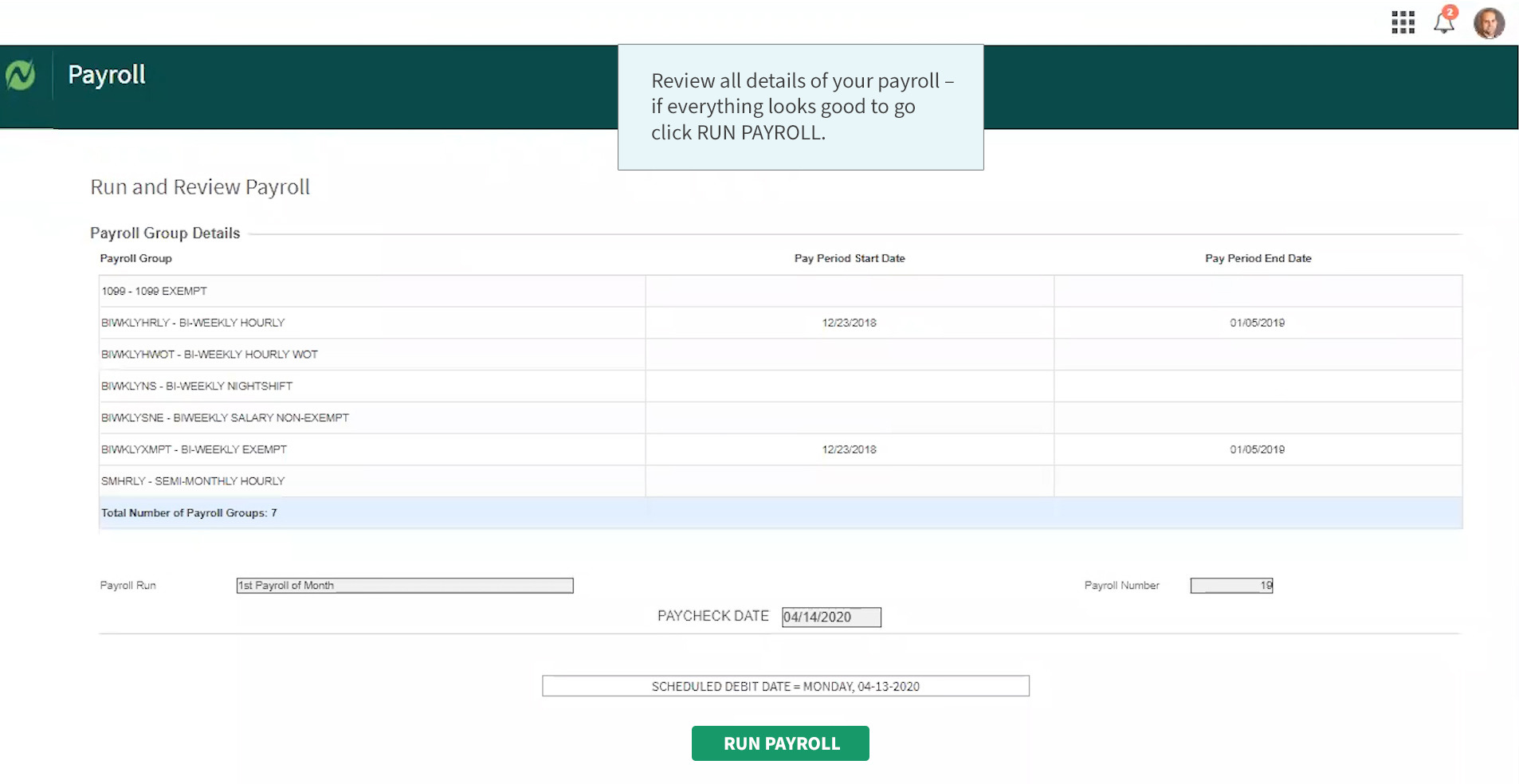

The Aggregate Bonus Calculator Netchex

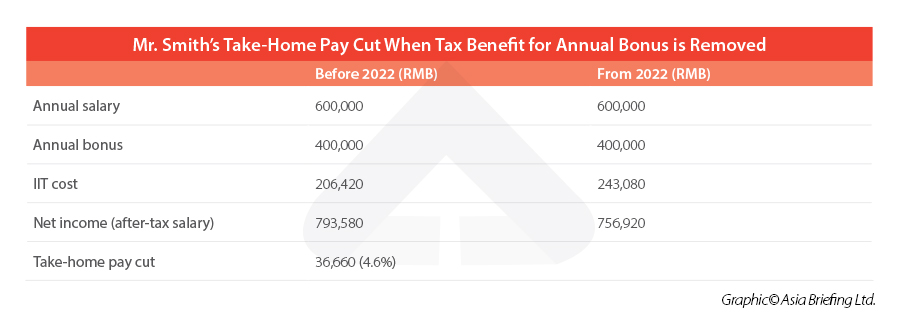

China Annual One Off Bonus What Is The Income Tax Policy Change

Driving Transformation Delivering Growth Deepening Sustainability

Why Are Liberals Advocating For High Taxes On Rich People Who Worked Hard For Their Money Quora

March 2023 Saddle Up Magazine By Saddle Up Magazine Issuu

How Bonuses Are Taxed Calculator The Turbotax Blog